Series: Disaster After Disaster

Growing Storms, Faltering Aid

This article was produced for ProPublica’s Local Reporting Network in partnership with The Times-Picayune | The Advocate and WWL-TV. Sign up for Dispatches to get stories like this one as soon as they are published.

The complaints started as soon as Louisiana launched its massive program to help homeowners rebuild after hurricanes Katrina and Rita in 2005. Community leaders said the largest rebuilding program in U.S. history would be unfair to the state’s poorest residents.

Activists and real estate experts spoke out at meetings of the Louisiana Recovery Authority, which designed and ran the Road Home program. An attorney representing poor homeowners testified before Congress. A fair housing group sued the state and federal governments.

State officials made tweaks and settled the lawsuit, but they never changed a core part of the formula that determined how much homeowners received.

Now a groundbreaking analysis of nearly 92,000 rebuilding grants statewide shows critics were right all along: Road Home shortchanged people in poor neighborhoods while giving those in wealthy neighborhoods more of what they needed.

People in the most impoverished areas in New Orleans — those with a median income of $15,000 or less — had to cover 30% of their rebuilding costs after Road Home grants, Federal Emergency Management Agency aid and insurance. In areas where the median income was more than $75,000, the shortfall was 20%, according to the analysis by ProPublica, The Times-Picayune | The Advocate and WWL-TV.

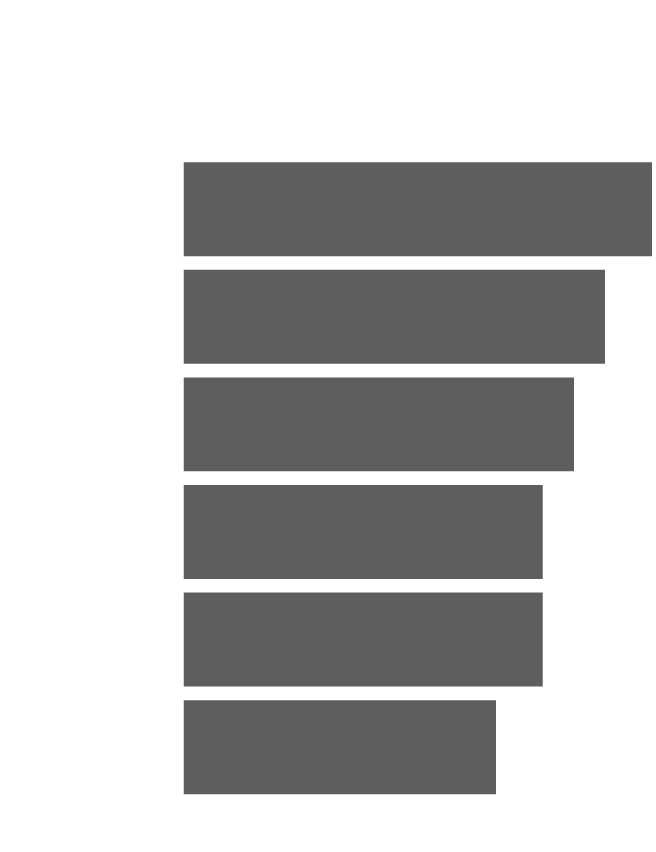

Lower-Income Homeowners in New Orleans Had Less of Their Hurricane Damage Covered by Road Home Grants

Median household income

Damage left uncovered for all properties in each income group

30%

<$15K

$15-30K

27%

25%

$30-45K

$45-60K

23%

23%

$60-75K

>$75K

20%

Poverty tracks closely with race in New Orleans, so the shortfalls in the city disproportionately hurt Black people. Road Home also underpaid residents of St. Bernard Parish, a mostly white, working-class community devastated by the hurricane.

Had properties in the lowest-income parts of New Orleans been covered at the same rate as the wealthiest, each of those households would have received about $18,000 more on average. Across the city, covering all homeowners’ repair costs at the rate of the highest earners would have resulted in another $349 million for rebuilding.

The Road Home program was hugely consequential for Louisiana, and much more so for its largest city, most of which flooded after Katrina’s storm surge overwhelmed its levees. Most homeowners didn’t have adequate insurance. Facing the possibility of a mass exodus, state leaders devised Road Home to cover the gap and encourage people to rebuild.

Road Home also allowed homeowners to sell their property to the state and move elsewhere, though housing was scarce in the region. If homeowners didn’t stay in Louisiana, they forfeited 40% of their home’s value.

New Orleans was the biggest beneficiary of rebuilding grants, and half of all owner-occupied homes in New Orleans received rebuilding grants, with $3.3 billion awarded citywide. Some neighborhoods rebounded quickly. Others languished.

Housing advocates say that’s due to the original sin of the Road Home program: It calculated each grant based on a home’s value before the hurricane or on the cost of repairs — whichever was less.

The value of most homes in poor areas was lower than the cost of rebuilding them, so the resulting grants didn’t cover all repairs. But for most people in affluent areas, the rebuilding cost was lower than the value of their homes. They got grants that came closer to covering their needs.

“The practical effects of how this program shaped the city can still be seen today,” said Davida Finger, an attorney who testified to Congress in 2009 about unfairness in the Road Home program.

Poor New Orleanians had a much harder time covering the costs. For a homeowner in the lowest-income areas, it would have taken more than 43 months at the average annual salary to pay the cost of repairs not covered by Road Home, FEMA and insurance, the news outlets found. In the highest-income areas, it would have taken less than eight months.

The shortcomings in the Road Home program are part of a broader tapestry of failures in the ways America helps people affected by catastrophes. A yearlong investigation by ProPublica, The Times-Picayune | The Advocate and WWL-TV has found that disaster programs often shortchange the people who need it most, worsening inequities in the wake of disaster.

Finger said the news organizations’ findings were “shocking but not surprising.”

“What Black homeowners, what lawyers, what advocates, what community organizers, what reporters were telling the program designers all along was completely accurate,” Finger said. “They simply didn't want to hear it.”

The state Office of Community Development took issue with the analysis, but none of the points it raised affected the news organizations' findings.

Two officials who were in charge of the recovery told the news outlets that the findings were troubling.

Andy Kopplin, the first executive director of the Louisiana Recovery Authority, stressed that state officials took pains to steer more money to poorer homeowners through a second grant program. But Kopplin acknowledged in a written statement that the findings show that low- and middle-income households should’ve received more.

That’s “upsetting to those of us who were working to create more equitable outcomes and especially to those families who needed and deserved more resources for their recovery,” he wrote.

Walter Leger, who was a key board member of the LRA, said the findings should spur the state to seek more federal aid from Congress to fill the gaps.

De’Marcus Finnell, deputy press secretary for the U.S. Department of Housing and Urban Development, declined to address the findings directly. But in a statement he said HUD’s experience after Katrina led it to favor programs that guide homeowners through rebuilding rather than giving homeowners money “and letting them manage the recovery process on their own.”

In fact, federal rules no longer allow homeowners to be compensated for losses after a disaster, and Leger said using property values to determine aid after Katrina now appears to have been a misstep.

“The plan was to help the homeowner repair his home or her home and get back in the home,” Leger said. The news organizations’ analysis shows there were disparities, he said, and “that's something that should have been, and maybe should be, addressed.”

One City, Two Recoveries

Before Katrina, the neighborhoods of Lakeview and Gentilly Woods had a lot in common. Both sat below sea level on reclaimed swampland near Lake Pontchartrain. They boasted similar post-World War II housing stock.

Lakeview was almost entirely white, and Gentilly Woods was more than two-thirds Black. Lakeview residents had higher incomes, and their homes commanded higher prices.

Both neighborhoods were swamped when the floodwalls along New Orleans’ drainage canals buckled after Katrina. Water reached the eaves of many homes.

Road Home appraised the average Lakeview home at $326,000 and the average repair cost at $286,000. With a grant based on the repair cost, the average homeowner received 83% of what was needed to rebuild, according to the news organizations’ analysis.

In Gentilly Woods, the average property was valued at $121,000, with $203,000 in rebuilding costs. With a grant based on the home’s value, the average homeowner ended up with just 73% of what was needed to rebuild.

Among those served well by Road Home was Lakeview retiree Rita Legrand, 86. She had to gut her modest ranch home. But she was determined to rebuild.

With $53,000 from insurance in hand, Legrand applied for a Road Home grant in fall 2006. Road Home estimated her home’s value at $320,000 and her repair costs at $188,000. Her grant, based on repair costs minus what she’d already gotten from insurance, was $135,000.

The grant and insurance proceeds covered her entire loss, as it was supposed to, and by April 2007 she had completely rebuilt. “The program worked great for me,” she said.

The experience was quite different for Cynthia and Charles Heisser of Gentilly Woods. Like Legrand, the Heissers had a small ranch house, and they had a similar repair estimate: $190,000. But their initial grant was just $32,000.

Charles Heisser, a 90-year-old Korean War veteran, still has the documents explaining how Road Home arrived at that figure.

Program officials estimated the pre-storm value of their home at $83,000. The state subtracted $40,000 in insurance proceeds, which their lender had made them use to pay off their mortgage, and $10,500 in FEMA aid they had received for living expenses.

Charles Heisser appealed, arguing Road Home had failed to factor in tens of thousands of dollars in improvements they had made before the storm. Their home was reappraised for $135,000.

That increased their grant to about $83,500. Even then, their total compensation including insurance and FEMA grants was $135,000 — just 70% of Road Home’s original estimate of what it would take to make their home livable.

The Heissers spent some of the Road Home grant to convert their garage into living quarters so they could move out of the FEMA trailer in their front yard. For most of the next 10 years, the house sat with a new roof and an unfinished interior where they hung laundry.

Cynthia Heisser couldn’t help but notice how differently things went in mostly white parts of New Orleans.

“It was unjust, more unjust to the Blacks than it was to the whites,” she said. People used to ask her, she recalled, “‘Oh, you don’t have your house yet?’ Or ‘You’re not in your home yet?’ And we’d say, ‘It isn’t because we're not fighting for it. We are.’”

A nonprofit called Rebuilding Together New Orleans eventually provided labor and materials to help finish repairs. The Heissers finally moved back into their house in 2018 — 13 years after the storm.

“Victims of Hurricane Katrina Were Being Victimized Again”

From the beginning, Road Home had a problem. On the one hand, thousands of residents desperately needed rebuilding aid. On the other, Road Home, like many disaster aid programs, had guardrails to make sure people didn’t end up better off than before the storm.

The idea was that “it would be illegitimate for somebody whose house only had a market value of $100,000 to get $120,000, even if that was how much it would cost to repair,” said Andy Horowitz, a history professor at the University of Connecticut and author of “Katrina: A History, 1915-2015.”

When people complained that using home values to calculate grants would help some people more than others, officials argued that pre-storm value had been part of the formula from the start. Besides, Leger said at the time, it was required by the federal government, and there wasn’t enough time or money to change the rules.

In a June 2006 interview shortly after the program was approved, Louisiana Recovery Authority chair Norman Francis dismissed the very problem many poor homeowners would soon face — that the cost of rebuilding could far exceed the value of their homes.

“That money is going to cover the difference between your damages and how much insurance you got,” Francis said. “Now, if you had a $50,000 home, not likely that you had $200,000 worth of damage. So the formula has to take into consideration your home value.”

A family member said Francis, now 91, was unavailable to comment for this story.

Melanie Ehrlich, who lived in Baltimore while her Gentilly home was rebuilt, said she quickly saw the problem with the formula. She founded a grassroots organization, the Citizens’ Road Home Action Team, and became a thorn in the side of Road Home officials.

“It was crystal clear how very unfair the program was in its design,” said Ehrlich, a Tulane University genetics professor. “What I saw is that the victims of Hurricane Katrina were being victimized again.”

In October 2006, shortly after Road Home was launched, Ehrlich met with officials in charge of the recovery and argued their formula for calculating grants was unfair. She followed up with examples. Basing grants on the pre-storm value of homes, she wrote, would “justifiably anger the middle and lower economic classes, or, more specifically, everyone who does not have an expensive house or lot.”

As homeowners received their grant letters over the course of 2007, hundreds showed up at Finger’s low-income law clinic at Loyola University. She attended dozens of public meetings in Baton Rouge, New Orleans and Washington to ask officials to fix the inequity baked into the calculations.

In August 2009, Finger told a congressional committee that the formula disproportionately hurt Black residents because their homes tended to be valued for less. “Road Home’s grant formula design assured that some homeowners would not receive sufficient rebuilding funds,” she said.

Six state officials involved with the recovery effort said they didn’t ignore these complaints. But they noted that they were building a program of unprecedented scope and dealing with unforeseen problems, all while under intense pressure to get money to homeowners quickly.

Leger said he took Ehrlich’s complaint about pre-storm value to HUD officials and asked to use higher repair estimates instead. “We were told no,” he said.

Soon after the program launched, state officials said, they made changes that increased grants for all applicants: factoring land value into appraisals, using the highest of several appraisal methods and increasing rates for repair estimates.

They originally envisioned an affordable loan program to fill any gaps between grants and the actual costs of rebuilding, but it never got off the ground.

In 2007, they created another grant for less affluent homeowners whose initial grants didn’t meet their damage estimates. That enabled the state to meet a HUD requirement to pay at least half of grant money to low- and moderate-income households.

Three years later, after Black homeowners sued the head of the LRA and HUD alleging the program was discriminatory, Francis said, “That did not pass on my radar screen. If it had, I would have questioned why the program wasn’t treating people equitably.”

Francis was a revered civil rights leader and longtime president of Xavier University, a historically Black school, and Finger said she does not believe he and the other architects of Road Home intended it to be discriminatory.

Nonetheless, Finger said, “It is very difficult to look at a system that’s trying to roll out that much money as quickly as possible and to not do it in a way that replicates historic, systemic inequities.”

$297,000 in Damage, $3,468 in Aid

The plaintiffs in the suit included Almarie Ford, who said the hurricane shutters that adorn her New Orleans East home are all she ever got from Road Home.

A month after Katrina, Ford returned to find her Kingswood subdivision in ruins. The now-73-year-old social worker recalled walking into her house and gagging on the smell of black mold. She turned around, locked the front door and left, unsure what to do next.

Like many homeowners, she expected significant government assistance, but it never came. Road Home officials assessed her damage at about $297,000 but based her grant on her home’s value, $150,000. They gave her just $3,468 after subtracting about $146,500 in insurance payments.

If the grant had been based on rebuilding costs, she would have received the maximum Road Home grant of $150,000. Instead, Ford took out a loan and exhausted her savings.

“I was shocked,” Ford said of the size of her grant. “But what could you do? You could complain that you only got $3,500. But they said, ‘Well, those are the rules.’”

She wasn’t willing to accept what she described as an injustice without a fight. So she went to the Greater New Orleans Fair Housing Action Center.

In 2008, the housing center had joined with PolicyLink, a California nonprofit, to collect examples that showed Road Home’s formula disproportionately hurt poor communities and people of color.

Ironically, PolicyLink had teamed with the LRA two years earlier to present the state’s initial recovery plan. In a sign of just how unexpected the inequities were, a PolicyLink representative spoke at an LRA board meeting in April 2006 and “applauded the board for the design of the housing action plan,” according to meeting minutes.

James Perry, the head of the housing center, said his organization examined two nearly identical homes: four bedrooms, two bathrooms, brick construction. Each had flooded with 6 feet of water and had damages estimated at more than $200,000. But one house was in a white neighborhood and the other in a Black neighborhood.

Each homeowner received a grant based on their home value. Perry said the white homeowner got $150,000; the Black homeowner, $90,000.

Perry said his organization gave that information to Road Home and HUD, but neither took immediate action. Perry said he was shocked by what he perceived to be their lack of interest. “It wasn’t easy to remedy, but it seemed to me they would want to.”

In the resulting lawsuit, attorneys cited 2000 census data to prove their case: About 93% of Black-owned homes in New Orleans were valued at less than $150,000, compared to 55% of white-owned homes.

The homeowners secured an important victory before a federal district judge in 2010. The next year, the U.S. Court of Appeals for the D.C. Circuit overturned that ruling and sent the case back to district court, rejecting claims the grant formula was discriminatory.

The appeals court ruled that any gap in grants for Black families had been eliminated when, after the lawsuit had been filed, the state removed a $50,000 cap on the additional grant for low-income homeowners.

But the news outlets’ analysis shows the appeals court’s assessment was wrong. The additional grants did help homeowners in lower-income, nonwhite areas in New Orleans, most of which are majority Black. Thanks in part to the program, the average grant to a Black homeowner in Louisiana was slightly larger than the average grant overall, according to state records.

But in the end, the additional grants merely boosted the average share of damage covered by grants and insurance from about 51% to about 70% in those parts of New Orleans. That meant poor, nonwhite areas ultimately fared about the same as middle-income nonwhite areas, but not as well as even the poorest white ones.

The analysis backs up what U.S. District Court Judge Henry Kennedy wrote in 2010 in a preliminary ruling: “The Court does not take lightly that some African American homeowners received lower awards than they would have if their homes were in predominantly white neighborhoods.”

Louisiana and HUD “offered no legitimate reason for taking pre-storm home values into account” when calculating grants, he wrote.

While the appeals court accused plaintiffs of cherry-picking their data by focusing on majority-Black New Orleans, the news outlets’ analysis shows the disparity between wealthy and poor neighborhoods statewide was similar to that in New Orleans.

Three months after the appeals court ruling, Louisiana and HUD settled the lawsuit. The state agreed to put $62 million aside for yet another program, this one for people who made too much money to qualify for additional grants but needed more help.

It was a drop in the bucket. According to a state analysis in 2010, 25,000 New Orleans homeowners received a total of $1.2 billion less from the Road Home because their grants were calculated using pre-storm value rather than the cost of damage.

Despite being a plaintiff in the suit, Ford said she didn’t receive anything from the settlement. Fewer than 500 people did.

It took more than three years for her to complete repairs. During that time, she rented an apartment in Baton Rouge and continued to pay her mortgage, a strain that she said nearly broke her.

“It didn’t work for the people it was supposed to work for,” Ford said of the recovery program. “None of the people that I know in New Orleans East actually got any Road Home money. A lot of people, especially people who are more elderly, they just didn’t come back.”

Silence in the Seventh Ward; McMansions in Lakeview

One morning in September, Lynette Boutte picked up a piece of artwork in her Seventh Ward beauty salon. In the middle was a photo illustration of hundreds of Black people near the intersection of North Claiborne and Orleans avenues.

It depicted Super Sunday in 2003, two years before the storm. Boutte gazed wistfully, as if she could still hear the calls of the Mardi Gras Indians that day. Since Katrina, there hasn’t been such a raucous Super Sunday celebration in her neighborhood.

Music was once the lifeblood of the Seventh Ward, a working-class Creole neighborhood near the French Quarter. It has produced musical greats such as Jelly Roll Morton and John Boutte, one of her nine siblings.

After school, the sound of children playing trumpets would echo through the streets. In the evenings, musicians would fill her house for jam sessions.

The Seventh Ward doesn’t sing like it used to, she said. “There are no children in this neighborhood anymore.”

Boutte didn’t receive a dime from Road Home to rebuild, she said, because the state lowballed her property value and repair costs.

It took her nearly a decade, but she managed to rebuild with the help of relatives and church volunteers. Many weren’t so lucky.

Families who had lived in the neighborhood for generations were unable to return because they couldn’t afford to fix their homes. In the two decades after 2000, the number of children in the Seventh Ward dropped by more than a third, according to the Data Center, a community research nonprofit. The Black population in the Seventh Ward decreased by about 19 percentage points.

When asked how much responsibility the Road Home program shares for these changes, Boutte didn’t hesitate. “They are responsible for it all,” she said.

William Stoudt, executive director of Rebuilding Together New Orleans, which focuses on the Seventh Ward, said over the past 15 years his staffers have witnessed many people living in “completely substandard conditions.” Road Home’s grant formula is partly to blame, he said.

Residents who got shortchanged had to cut corners, often hiring subpar contractors and using cheaper materials, he said. Some abandoned their properties because they couldn’t afford to rebuild; others sold them to predatory developers at below-market prices.

“Most of the homeowners that we help work their entire lives for 11 bucks an hour at a hotel in the Quarter cleaning rooms day after day and have no savings,” he said. “They never had a chance.”

The community is now pockmarked with empty lots and abandoned homes. Nearly 1 in 4 Seventh Ward houses were vacant in 2020, a 51% increase compared to two decades prior, according to the Data Center.

In Lakeview, where Stoudt grew up, the post-Katrina recovery looks dramatically different.

Stoudt remembers standing in his street three weeks after the storm amid uprooted trees and abandoned cars covered in dried mud. The waterlogged front door of his family home had swollen shut. To get inside, his parents climbed a ladder and went in through a second-story window.

It was the silence, though, that haunted him. Stoudt said it seemed as if everything had died. “It was the quietest place you’ve ever been in your life.”

That silence was soon replaced by the sound of hammers and saws. His parents’ flood insurance policy covered the cost of repairs, so they didn’t need a Road Home grant. Construction began almost immediately. Within a year, their home had been rebuilt.

Today, he said, Lakeview is largely unrecognizable. People didn’t just rebuild, they expanded — replacing their ranch houses with multistory, modern homes.

“Now it’s McMansions, 4,000 square feet, double-lot monsters,” Stoudt said. “If you were in the right neighborhood, you got what you needed to rebuild.”

About the Data

To evaluate the impacts of the Road Home program, The Times-Picayune, ProPublica and WWL-TV obtained a novel dataset of more than 130,000 grants from the Louisiana Division of Administration. The anonymized dataset included, for each grant recipient in the state, the grant amounts, the pre-storm value of the property and any insurance and FEMA payouts. The analysis was conducted on a subset of 91,771 rebuilding grants that had valid grant and damage amounts, were not part of a lawsuit over errors in grant calculations and did not fall under a limited number of other circumstances that could yield incorrect information. Our analysis focused on 30,188 records from Orleans Parish and 5,911 from St. Bernard Parish.

For our analysis of demographics and income, we used data from Summary File 3 in the 2000 U.S. Census, downloaded from IPUMS NHGIS, University of Minnesota. This dataset contains survey responses from the longform census questionnaire, which was sent to approximately one in six households, and is available on the block group level. In the city of New Orleans, additional analysis using 2000 census data was conducted using Neighborhood Statistical Areas provided by the New Orleans Data Center, a nonprofit research center that defines those boundaries. Any use of “neighborhoods” refers to these boundaries. The word “areas” refers to census block groups.