This story is a collaboration between ProPublica Illinois and WBEZ Chicago, co-published with the Chicago Sun-Times.

ProPublica is a nonprofit newsroom that investigates abuses of power. Sign up to receive our biggest stories as soon as they’re published.

With the Illinois General Assembly poised to consider a tax hike on video gambling, some key lawmakers and their family members have developed previously undisclosed financial connections to the industry, meaning the fate of any proposal could lie in part on votes of legislators with a stake in the outcome.

They include two of the General Assembly’s most powerful figures, Senate Minority Leader Bill Brady, a Republican from Bloomington, and Chicago Democrat Antonio Muñoz, the Senate assistant majority leader, according to Illinois Gaming Board records obtained by ProPublica Illinois and WBEZ.

These ties, coupled with robust campaign giving by the industry, reveal how video gambling operators are building political influence at a time when the state is desperate to identify much-needed revenue to fund a capital program and balance the budget. Those operators hope to block a tax increase, pushing instead to raise the maximum bet from $2 to $4 and increase the number of machines allowed in each location from five to six.

The video gambling industry has spent lavishly on a lobbying campaign to stave off Gov. J.B. Pritzker’s February budget proposal to raise $89 million for a capital campaign through a tax increase on video slot and poker machines. Last week, the governor’s office followed up with a plan, Rebuild Illinois, which calls for $90 million in funding from video gambling but doesn’t specify how it would be raised.

Video gambling operators have cast any tax increase as an assault on small businesses, with slogans like “Save Main Street” and “Bet on Main Street.” But operating video gambling machines in Illinois has become big business, attracting national casino companies, private equity and hedge funds as well as wealthy real estate investors, records show. The top five video gambling operators control nearly 50% of the market, reaping nearly $1 billion in revenue between 2012 and 2018, according to an analysis of gaming board data.

Illinois’ tax rate on video gambling, meanwhile, is among the lowest in the country. Unlike the state’s casinos, which are taxed at a progressive rate that can reach as high as 50%, video gambling is taxed at a flat rate of 30%, with 25% going to the state and 5% to local governments.

Industry leaders have long been worried about a tax hike. In addition to their recent lobbying efforts, their trade group, the Illinois Gaming Machine Operators Association, nearly doubled its political giving last year, pumping nearly $230,000 into state and local campaigns, according to state campaign finance records.

Brady is listed in internal gaming board records as a “person with significant influence or control,” or PSIC, for Midwest Electronics Gaming, one of the state’s largest video gambling companies. Midwest, operating primarily in central Illinois, made $16 million from video gambling last year and $80 million between 2012 and 2018.

Brady’s designation as a PSIC means he receives a percentage of the proceeds from video slot and poker machines under a revenue-sharing agreement with Midwest. Although the terms and the locations of the machines are not disclosed, any tax increase on video gambling revenue would have a direct financial impact on him.

Yet required disclosure statements filed with the Illinois Gaming Board and available online do not list Brady as a PSIC. Instead, he’s listed as a sales agent, a middleman who contracts with video gambling operators to sign contracts with bars, restaurants and other alcohol-pouring establishments to install video slot and poker machines.

Sales agents, or finders, are not required to obtain licenses from the gaming board or disclose how much they are paid, although industry insiders say sales agents can earn as much as $50,000 for each location they sign up. The gaming board designates sales agents as PSICs when they have revenue-sharing agreements with operators. PSICs are required to undergo additional vetting by the gaming board, including criminal background checks.

Also listed in records obtained by ProPublica Illinois and WBEZ is Brady Ventures, a company the senator owns with his wife, Nancy, who is also listed as a PSIC. State records show Brady Ventures was formed in October 2011, a year before video gambling in Illinois went live.

The senator lists Brady Ventures but not Midwest on his legislative statements of economic interests, which are filed with the Illinois secretary of state under the Illinois Governmental Ethics Act. That’s because payments to Brady from Midwest go through Brady Ventures and are not made to him directly.

Through a spokesman, Brady declined to answer questions about his involvement in video gambling. Instead, he issued a statement saying he acts in the public interest.

“I have an interest in a company that has a contractual agreement with a video gaming company and have disclosed such,” the statement said. “Any information I offer regarding this issue during discussions is based on my personal knowledge of the industry, and I act in what I believe to be in the public interest. When deciding how to vote on any legislation involving video gaming, I consult with my ethics officer and either abstain from voting or vote in the public interest as required by the Illinois Governmental Ethics Act.”

A real estate broker by trade, Brady ran for governor in 2010 and lost to Pat Quinn, who signed the Video Gaming Act in July 2009, legalizing the once-illicit industry. Brady voted against the legislation when it came before the Senate in May 2009, records show. He began working with Midwest as a sales agent in July 2016. Brady was designated a PSIC in March 2018.

Midwest’s owner, Tim Jones, did not respond to an interview request.

The son of Muñoz, the Democratic Senate assistant majority leader, is also listed as an industry sales agent. Gaming board records show Antonio Muñoz IV is tied to Tap Room Gaming, which is co-owned by former Democratic State Sen. Michael Bond. Bond, who voted for the Video Gaming Act, founded Tap Room Gaming in August 2011, six months after leaving office.

Tap Room made nearly $62 million between 2012 and 2018 from its video slot and poker machines, which are located mainly in Lake County, north of Chicago, according to records from the gaming board.

Records show Muñoz IV began working for Tap Room in September 2016, eight months after leaving a $51,000-a-year job as a security officer with the Chicago Aviation Department. In that job, he was repeatedly suspended for not showing up for work, city records show.

“Tony was highly qualified for the position [with Tap Room] and was liked and respected by his co-workers, peers and supervisors,” Bond said in an email response to questions. “He is welcome to work with my company because he’s qualified and he works hard.”

Brady and Muñoz have held seats on the powerful Joint Committee on Administrative Rules, which must approve regulations governing the video gambling industry. Brady left the committee in late 2017. Muñoz, who did not respond to a request for an interview, remains. Efforts to reach the younger Muñoz were unsuccessful.

State Sen. Thomas Cullerton, a Democrat from Villa Park and a distant cousin of Senate President John Cullerton, is listed as a sales agent for Global Gaming Industries. Global Gaming currently contracts with one licensed location that has generated revenue, Rubi Agave, a Latin bar and restaurant in Homer Glen, southwest of Chicago. As of March, the restaurant had brought in about $7,200 this year.

In November, the gaming board voted to revoke Global Gaming’s license because of its ties to a man with “an extensive criminal record,” though Global Gaming has continued to operate while it appeals the decision. Separately, Cullerton has been the subject of subpoenas from federal investigators seeking records related to an ongoing criminal investigation of Teamsters boss John Coli Sr., who allegedly extorted $100,000 in cash from a local business.

Global Gaming and Cullerton did not respond to requests for comment.

State lawmakers aren’t the only political figures who benefit financially from video gambling. Last June, Cook County commissioners voted to approve video gambling in unincorporated parts of the county. The hearing was presided over by Deborah Sims, a Democrat from Posen who has been a sales agent for Gold Rush Gaming since May 2017, according to gaming board records.

Sims presided over the hearing and voted present on the ordinance — even as one of its owners, Rick Heidner, testified at the hearing. Also voting present was Commissioner Peter Silvestri, an Elmwood Park Republican who’s been a sales agent for Gold Rush since 2014. Gold Rush has made $130 million from video gambling between 2012 and 2018, according to gaming board data.

Sims did not respond to a request for an interview. Silvestri said that his contract with Gold Rush was through his consulting firm, PNS Consulting, and that “there’s nothing improper about it.” He said the work involved “mainly asking people you knew” who own restaurants or bars if they want to install the company’s machines. “I didn’t go knocking on doors.”

The first part of an ongoing ProPublica Illinois-WBEZ investigation, published in January, found that Illinois’ tax rate on video gambling is among the lowest in the country. In West Virginia and South Dakota, video gambling is taxed at 50%. In Oregon, where the government owns and operates video gambling machines through the state lottery, the tax rate is 73%. Pennsylvania, which recently legalized video gambling, will tax the industry at 52%.

States Where Video Gambling Is Legal Outside of Casinos

Loading...

The Illinois Gaming Machine Operators Association wrote the Video Gaming Act legislation and tried for years to get it approved by the General Assembly. Following the 2008 financial crisis, state lawmakers legalized video slots and poker, vowing the industry would raise $300 million a year for a massive building program called Illinois Jobs Now!

But it took nearly a decade for revenues to reach projections. The funding structure also left large shortfalls in regulatory and social costs. Illinois ranked 28th out of 40 states with significant gambling operations in funding for gambling addiction. While the gaming board spends at least $17 million a year to regulate the industry, licensing and administrative fees set aside to cover those costs amounted to about $5.5 million in 2018, in part because the fees are much lower than in other states.

In February, the day before Pritzker announced his tax increase proposal, Accel Entertainment CEO Andrew Rubenstein wrote an email to investors warning that “several legislative leaders have expressed that there may be an increase in the 30 percent tax rate on video gambling,” according to emails obtained by ProPublica Illinois and WBEZ.

“We are closely tracking this development and are responding with our team of lobbyists,” Rubenstein wrote.

The state’s largest video gambling operator, Accel controlled 1,686 of the state’s 6,773 locations and 7,649 of the 30,694 video slot and poker machines by the end of 2018, according to Rubenstein’s email to investors. The company has made nearly $351 million since 2012, gaming board data shows. In March alone, Accel collected nearly $13 million from its video gambling machines.

Accel, along with the second-largest operator, J&J Ventures, and Tap Room Gaming sponsored a lobbying blitz to fend off Pritzker’s tax increase proposal. In early May, a parade of people wearing powder-blue “Bet on Main Street” T-shirts filed into the Illinois Capitol to hold a press conference and wander the halls lobbying legislators.

It appeared to be a grassroots movement of small business owners trying to persuade lawmakers not to harm their bars and restaurants, with local bar owners speaking at a press conference. In reality, it was the culmination of a monthslong campaign carried out by Washington lobbying firms, including one with connections to House Speaker Michael Madigan and funded by Accel, J&J and Tap Room.

The campaign was coordinated in part by the Cornerstone Group, whose Illinois office is run by Will Cousineau, a former Madigan political director who served on the speaker’s staff for 18 years before leaving in June 2017. The Bet on Main Street Coalition built a website, held a petition drive and orchestrated the push at the Capitol to rail against Pritzker’s proposal to increase taxes.

Interviews, as well as emails from operators to their employees, reveal that people attending the rally included employees of Accel, J&J and Tap Room. Some of these workers said they were required to go and instructed not to wear clothing with their company logos or to talk to reporters.

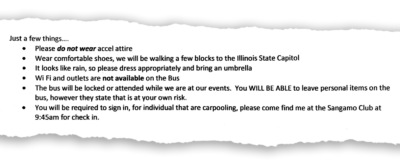

In the days leading up to the rally, Accel executives emailed employees: “Just a few things … please do not wear Accel attire.”

The Bet on Main Street Coalition event did include small bar and restaurant owners who have benefited from video gambling. They included Doug Rankin, owner of Longbranch Tavern in Athens, a town of about 2,000 people just north of Springfield.

“It’s been very good,” he said. “I’ve added on [to the bar]. I’ve hired other people. I’ve bought a walk-in cooler.”

Gaming board records show that Rankin made about $87,000 from video gambling machines last year, far less than the $2.5 million revenue threshold that would trigger the higher tax under Pritzker’s February proposal. J&J Ventures, the company that supplied the video slot and poker machines to Rankin and helped fund the Bet on Main Street Coalition, made $74 million on video gambling in 2018 and more than $249 million between 2012 and 2018.

In response to requests for interviews with executives from Accel, J&J and Tap Room, a senior associate from the Washington-based communications firm SKDKnickerbocker responded, citing the importance of the industry to the state and pointing to an industry-funded study that found video gambling “directly employs roughly 2,000 people and supports another 30,000 employees at roughly 6,700 establishments statewide.”

“The Bet on Main Street coalition is made up of small businesses and other stakeholders who oppose the governor’s proposal to raise taxes on the industry.”

There is no publicly available bill on increasing the tax on video gambling. But Pritzker is seeking an additional $90 million from video gambling, according to the plan released last week. His proposal in February called for a 50% tax on owners of multiple establishments that together earn more than $2.5 million a year.

As currently described, the tax would not apply to video gambling operators, yet the companies clearly see it as a threat.

“The fact is, any proposal that raises taxes will cut into video gaming revenues for veterans’ organizations and local small business who rely on that revenue,” the response from SKDKnickerbocker said.

Nothing prevents lawmakers from taxing operators who provide the machines — and receive most of the proceeds — rather than locations.

Since video gambling went live in September 2012, players around the state have lost about $5.8 billion. Of that, the state has received almost $1.5 billion in tax revenue while local governments have received nearly $290 million.

Establishments and video gambling operators have split the remaining revenue, nearly $4.1 billion, evenly. But there have always been many more establishments than operators dividing up the revenues. In March, 6,912 establishments split proceeds with 55 operators, according to gaming board records.

In March, players in Illinois deposited nearly $620 million into video poker and slot machines, losing a quarter of what they wagered, or $159 million. The average operator brought in more than $1 million that month. The average amount per location: about $8,000.

Rather than increasing the tax on video gambling, operators have urged lawmakers to allow them to double the maximum bet on video slots and poker from $2 to $4. This would increase profits but, according to gambling addiction counselors, exacerbate problem gambling.

A ProPublica Illinois analysis of demographic and gaming board data has found that, more often than not, the machines are located in lower-income communities and that as the average income level of a municipality decreases, the average number of machines increases.

The industry is also pushing for an increase in the maximum number of machines allowed at each location from five to six. Illinois already has more video gambling machines outside of casinos than any other state in the country — and more locations to place a bet than Nevada.

Gaming board records show that by March, the state had 31,481 video slot and poker machines scattered across 6,912 locations. Nevada had 19,105 slot machines in about 2,220 locations outside of casinos.

Lawmakers will have to make a decision on a tax hike by the end of the legislative session on May 31 or come back to the issue in the fall.

Video Gambling Has Exploded in Illinois, but Promises of a Financial Windfall Have Come Up Short

Since Illinois legalized video gambling in 2009, tens of thousands of machines have been installed all over the state, except in communities where local ordinances prohibit them, such as Chicago. By hitting “play” below, you can watch the revenue generated by the machines grow over time and how those revenues failed to meet the projections of legislators.

Loading...

Filed under: