Debt

Series

Financial Aid Loophole

Giving Up Guardianship to Get Aid

The Bad Bet

How Illinois Bet on Video Gambling and Lost

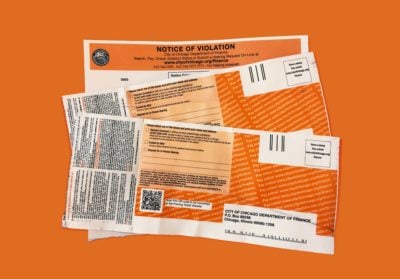

Driven Into Debt

How Tickets Burden the Poor

Too Broke for Bankruptcy

How Bankruptcy Fails Those Who Need It Most

Debt Inc.

Lending and Collecting in America

Foreclosure Crisis

How Banks and Government Fail Homeowners

Stories

Are Colorado’s Efforts to Curb HOA Foreclosures Working?

Homeowners associations have filed far fewer foreclosure cases since the state enacted a law aimed at protecting residents in disputes with their HOAs, according to a ProPublica-Rocky Mountain PBS analysis.

HOA Foreclosures Are a “Lose-Lose” Game for Coloradans, but These Lawyers Win Regardless of the Outcome

A retired NFL player’s legal battle with a homeowners association spotlights why critics say Colorado law incentivizes attorneys to advise that HOAs foreclose on residents rather than find less expensive solutions.

Consumer Financial Protection Bureau Fines TitleMax $15 Million for Predatory Lending

The federal consumer watchdog group says the Georgia-based company intentionally evaded laws meant to protect military families from predatory lenders.

Inside the Controversial Sales Practices of the Nation’s Biggest Title Lender

Former TitleMax store managers told ProPublica and The Current about how they were trained to keep customers unaware of the true costs of their title pawns. When they were more transparent, they faced repercussions.

How Title Lending Works

Title lenders in the U.S. often use predatory practices to trap customers in high-interest loans, ProPublica recently reported. This guide will help you understand how title lending works and what your options are if you’re stuck in a contract.

How Title Lenders Trap Poor Americans in Debt With Triple-Digit Interest Rates

For some Georgia residents, title pawn contracts offer a quick way to obtain desperately needed cash. But poor regulation of a confusing system traps many borrowers in high-interest debt they can’t pay off.

Ohio Lawmakers Seek Strict Rules for “Clean Energy” Lending

A statewide clean-energy lending program in Ohio stalled last year before making any loans. Lawmakers want to add consumer protections in case the program resurfaces.

Michigan’s Largest Utility Faces Pushback on Debt Sales and Shut-Offs as Company Asks for Rate Hike

As DTE Energy pushes for a rate increase, the state is taking a closer look at its sale of customer debt to collection agencies. The company’s use of shut-offs and response to outages are also drawing criticism.

Colorado Legislature Passes HOA Foreclosure Reform Bill

The measure limits homeowners associations’ ability to foreclose on residents who accumulate fines for violating community rules known as covenants.

Colorado HOA Foreclosure Reform Legislation Moves Forward

The bipartisan measure would limit homeowners associations’ powers to file foreclosure cases based on fines for community-rule violations, capping such penalties and increasing due process for homeowners.

They Faced Foreclosure Not From Their Mortgage Lender, but From Their HOA

While most homeowners associations refrain from the “last resort” of foreclosing on residents, some Colorado communities have moved time and again to take members’ homes.

A Return to Robo-Signing: JPMorgan Chase Has Unleashed a Lawsuit Blitz on Credit Card Customers

After a nearly decade-long pause, Chase has resumed suing indebted customers. The bank is back to its old ways, say consumer lawyers.

Chicago Mayor Lori Lightfoot Proposes Further Traffic Ticket Reforms to Help Low-Income Motorists

In 2018, ProPublica reported on how vehicle tickets in Chicago disproportionately harm low-income, Black residents. This latest set of reforms proposes lowering ticket costs and providing debt relief for low-income residents.

Loan Forgiveness for Disabled Borrowers Was 10 Years in the Making

At ProPublica, we measure our success by the tangible impact our stories have. Sometimes it takes more than a decade to see a flawed policy change.

The Education Department Will Forgive $5.8 Billion in Student Loans for Disabled Borrowers

A troubled Education Department program left many disabled borrowers unable to escape crushing debt. A decade after ProPublica exposed the issue, the US has taken a major step to address the program’s defects.

Cities in Ohio Want to Use the Same Clean-Energy Financing Company That Saddled Missouri Homeowners With Debt

An Ohio city had a low-interest loan program for energy-saving home improvements. Now, the officials who run it plan to turn it over to the same company behind Missouri's troubled program.

Some Hospitals Kept Suing Patients Over Medical Debt Through the Pandemic

Court actions by hospitals to collect patient debt dropped sharply during the pandemic. But a new study says some of the nation’s largest hospital systems kept filing lawsuits, liens and garnishments — and most were nonprofit.

Missouri Lawmakers Approve Reforms to Controversial Clean-Energy Loan Program

Lawmakers approve consumer protections and oversight to PACE loans that have disproportionately burdened borrowers in Black neighborhoods.

Clean-Energy Loans Trapped Black Homeowners in Debt. The Legislature Just Started Trying to Fix the Problem.

Lawmakers in Missouri are exploring ways to rein in the state’s clean-energy loan program, which ProPublica found disproportionately harms Black homeowners.

State-Supported “Clean Energy” Loans Are Putting Borrowers at Risk of Losing Their Homes

Dozens of Missouri homeowners who used PACE loans to fix up their houses ended up trapped in debt and could soon see their homes sold at auction.

There’s Only One State Where Falling Behind on Rent Could Mean Jail Time. That Could Change.

Only Arkansas permits criminal consequences for nonpayment of rent — and it has enforced the law during the pandemic. Now, after ProPublica investigated the practice, some legislators want to revoke the statute.

Feds Investigating Lender That Sued Thousands of Lower-Income Latinos During Pandemic

Oportun Inc., a small-dollar loan company, disclosed to investors that it is the subject of a probe by the Consumer Financial Protection Bureau following reporting by ProPublica and The Texas Tribune.

Thousands of Illinois Drivers Would Get Their Licenses Back Under a Criminal Justice Reform Bill

If Gov. J.B. Pritzker signs the measure that lawmakers passed this week, motorists will no longer lose their licenses for unpaid red-light and speed camera tickets.

Donald Trump Built a National Debt So Big (Even Before the Pandemic) That It’ll Weigh Down the Economy for Years

The “King of Debt” promised to reduce the national debt — then his tax cuts made it surge. Add in the pandemic, and he oversaw the third-biggest deficit increase of any president.

A Lender Sued Thousands of Lower-Income Latinos During the Pandemic. Now It Wants to Be a National Bank.

Oportun, which lends in only a dozen states, applied for a bank charter late last year. Consumer and Latino civil rights groups are pushing back, citing the findings of a joint investigation by ProPublica and The Texas Tribune.

JPMorgan Chase Bank Wrongly Charged 170,000 Customers Overdraft Fees. Federal Regulators Refused to Penalize It.

Documents and records show that bank examiners have avoided penalizing at least six banks that incorrectly charged overdraft and related fees to hundreds of thousands of customers.

The Pandemic Hasn’t Stopped This School District From Suing Parents Over Unpaid Textbook Fees

When the pandemic started, several school districts in Indiana halted a long-standing practice: suing families for unpaid textbook fees. But one school district has filed nearly 300 lawsuits against parents, and others also have returned to court.

New Bill Proposes Stopping Unemployment Agencies That Make Mistakes From Demanding Money Back

State unemployment agencies have been demanding recipients repay thousands of dollars, even if the agency made the mistake and the money’s already been spent. After ProPublica investigated the practice, legislators are trying to end it.

Nonprofit Hospital Almost Never Gave Discounts to Poor Patients During Collections, Documents Show

We reported how Memphis’ largest hospital system sued thousands of poor patients. Now, new data shared with Sen. Chuck Grassley shows the system collected $169 million in past-due bills, but only 1% received financial assistance during collections.

A Guide to Navigating the Texas Unemployment System During the Coronavirus Pandemic

People across the Lone Star State are struggling to navigate a maze-like system to get the benefits they are entitled to. Here are the answers to the most common questions about getting benefits from the Texas Workforce Commission.

The Fed Saved the Economy but Is Threatening Trillions of Dollars Worth of Middle-Class Retirement

The Federal Reserve has bailed out the stock and bond markets and stabilized the economy with its rock-bottom rates — but at the expense of Social Security and pension funds.

Help Us Investigate Collection Practices at Virginia Colleges and Universities

Academic institutions are sending students’ unpaid tuition bills to collection agencies and courthouses. Has this happened to you or anyone you know?

Debt Collectors Have Made a Fortune This Year. Now They’re Coming for More.

After a pause for the pandemic, debt buyers are back in the courts, suing debtors by the thousands.

What Happens After a Debt Collection Machine Grinds to a Halt

One year ago, Methodist Le Bonheur hospital system erased nearly $12 million of medical debt after an investigation from MLK50 and ProPublica. We checked in with two women who have new jobs and a new optimism about their future.

La empresa prestamista que demandó a miles de latinos de bajos ingresos durante la pandemia

Una investigación de meses reveló que Oportun, Inc., empresa fundada para ayudar a los inmigrantes latinos a establecer un historial de crédito, utiliza demandas judiciales rutinariamente, con el fin de intimidar a esta población vulnerable para que se mantengan al día con los pagos de sus préstamos de alto interés, incluso durante COVID-19.

Cómo determinamos cuántas demandas de cobranza de adeudos presentó Oportun Inc. durante la pandemia

Los juzgados de paz, donde se presenta la mayoría de las reclamaciones de adeudos en Texas, no tienen el requisito de documentar información a nivel de caso. Aquí presentamos cómo las reporteras de ProPublica y The Texas Tribune lograron revelar una de las tácticas más agresivas de la empresa.

The Loan Company That Sued Thousands of Low-Income Latinos During the Pandemic

A monthslong investigation revealed that Oportun Inc., which was founded to help Latino immigrants build credit, routinely uses lawsuits to intimidate a vulnerable population into keeping up with high-interest loan payments — even amid COVID-19.

How We Found Out How Many Debt Collection Lawsuits Oportun Inc. Filed During the Pandemic

Justice of the peace courts, where a majority of debt claims are filed in Texas, aren’t required to report case-level information. Here’s how ProPublica and Texas Tribune reporters got around it to reveal one company’s aggressive tactics.

She Was Sued Over Rent She Didn’t Owe. It Took Seven Court Dates to Prove She Was Right.

In one of the country’s richest cities, the public housing authority aggressively sued its residents, filing complaints for amounts as little as $5. Some residents were sued over the authority’s own mistakes.

Demandaron a miles de prestatarios durante la pandemia, hasta que comenzamos a hacer preguntas

A meses de haber comenzado la pandemia, un prestamista que se comercializa entre los inmigrantes latinos siguió demandando a sus prestatarios, a pesar de que estos perdieron sus empleos y se retrasaron con sus pagos. No obstante, la compañía dio marcha atrás cuando nosotros comenzamos a hacer preguntas.

They Sued Thousands of Borrowers During the Pandemic — Until We Started Asking Questions

Months into the pandemic, a lender that markets to Latino immigrants continued to sue borrowers after they lost jobs and missed payments. But they reversed course when we started asking questions.

The Eviction Ban Worked, but It’s Almost Over. Some Landlords Are Getting Ready.

The CARES Act was largely successful in keeping millions of American renters from facing eviction during the pandemic. As protections fade, some landlords are gearing up to return to court.

Capital One and Other Debt Collectors Are Still Coming for Millions of Americans

As the COVID-19 pandemic hit, Americans got protection from evictions, foreclosures and student debt. But debt collectors have continued to siphon off their share of paychecks from those who still have jobs.

These Hospitals Pinned Their Hopes on Private Management Companies. Now They’re Deeper in Debt.

At least 13 hospitals in Oklahoma have closed or experienced added financial distress under the management of private companies. Some companies charged hefty management fees, promising to infuse millions of dollars that never materialized.

This Treasury Official Is Running the Bailout. It’s Been Great for His Family.

Deputy Treasury Secretary Justin Muzinich has an increasingly prominent role. He still has ties to his family’s investment firm, which is a major beneficiary of the Treasury’s bailout actions.

This Billionaire Governor’s Been Sued Over Unpaid Bills. A Judge Just Ordered Him to Pay More.

On Wednesday, another company owned by Gov. Jim Justice was ordered to pay nearly $2.8 million in a judgment over unpaid bills. The ruling comes just weeks before West Virginia’s primary election, where Justice is campaigning for a second term.

A Closer Look at Federal COVID Contractors Reveals Inexperience, Fraud Accusations and a Weapons Dealer Operating Out of Someone’s House

The Trump administration has promised at least $1.8 billion to 335 first-time contractors, often without competitive bidding or thorough vetting of their backgrounds.

The Billionaire Governor Who’s Been Sued Dozens of Times for Millions in Unpaid Bills

Gov. Jim Justice is West Virginia’s richest man. Over the last three decades, lawsuits over unpaid bills have cost his constellation of companies more than $128 million in judgments and settlements.

See Who’s Taken Gov. Jim Justice to Court Over Unpaid Bills

West Virginia Gov. Jim Justice, a billionaire and the state’s richest man, has a long list of debt-collection cases. In the most complete analysis of his legal record to date, ProPublica found dozens totaling more than $128 million.

The Financial Catastrophe That Coronavirus Brought to Small Towns

The federal government has abandoned America’s small towns as the coronavirus depletes their budgets. It’s flood season and local leaders have no idea how to help residents through natural disasters. “We do not see how we will survive,” one told us.

Another Private Jet Company Owned by a Trump Donor Got a Bailout — This One for $20 Million

The two private jet companies are among the first 96 airline companies disclosed as recipients of taxpayer funds under the CARES Act.

The Trump Administration Says a New Bailout Program Will Help 35 Million Americans. It Probably Won’t.

Experts from across the political spectrum fear that the Federal Reserve’s new Main Street Lending program won’t reach enough businesses or save enough jobs.

The Bailout Is Working — for the Rich

The economy is in free fall but Wall Street is thriving, and stocks of big private equity firms are soaring dramatically higher. That tells you who investors think is the real beneficiary of the federal government’s massive rescue efforts.

One Thing the Pandemic Hasn’t Stopped: Aggressive Medical-Debt Collection

U.S. hospitals are in the spotlight for being on the frontline of fighting the pandemic. But in the shadows, debt collection operations continue, often by the same institutions treating coronavirus patients, all while unemployment and uncertainty soar.

Coronavirus Put Her Out of Work, Then Debt Collectors Froze Her Savings Account

Kim Boatswain’s tax refund could have helped her get through the coronavirus slowdown. But debt collectors seized it. There are few options for Texans like Boatswain whose money was taken just before the state temporarily banned such garnishments.

For Americans With Bills to Pay, Help Is on the Way. Sort Of.

Politicians have touted debt relief, but the various proposals are patchwork. Many homeowners and renters won’t get much help; those struggling with credit card, car and other loan payments will get none.

Having Trouble With Your Rent, Mortgage or Debts? We Want to Hear From You.

Will banks, landlords and other debt collectors work with people who’ve lost income because of the coronavirus crisis? Help us find out.

Chicago Temporarily Halts Some Debt Collections and Ticketing Amid Coronavirus Pandemic

Mayor Lori Lightfoot said the move to waive late penalties on city debts and stop the booting of vehicles was aimed at helping low-income residents.

Beginner’s Luck: How One Video Gambling Company Worked the Odds and Took Over a State

Funded in part by his wealthy family and aided by a personal connection at the Illinois Gaming Board, Andrew Rubenstein’s Accel Entertainment now owns a third of the state’s video gambling machines, making it the biggest video gambling operator in the nation.

A State Senator Had Thousands of Dollars in Ticket Debt. Now She’s Fighting to Make Sure Others Won’t.

Our Q+A with Illinois state Sen. Celina Villanueva, who introduced a bill to end driver’s license suspensions for unpaid red-light tickets.

Utah Representative Proposes Bill to Stop Payday Lenders From Taking Bail Money from Borrowers

Debtors prisons were banned by Congress in 1833, but a ProPublica article that revealed the sweeping powers of high-interest lenders in Utah caught the attention of one legislator. Now, he’s trying to do something about it.

Tens of Thousands of People Lost Driver’s Licenses Over Unpaid Parking Tickets. Now, They’re Getting Them Back.

Gov. J.B. Pritzker signed legislation Friday to end license suspensions for unpaid parking tickets, affecting nearly 55,000 Illinois motorists. Lawmakers cited ProPublica Illinois and WBEZ Chicago reporting for leading to the new law.

How to File Your State and Federal Taxes for Free in 2020

TurboTax and other tax prep services advertised themselves as “free,” but we found several ways that they tricked people into paying. Here's our guide to preparing and filing your taxes without falling into a trap.

Our Journalists Stopped Calling People Hard-to-Reach and Listened to Them. Here’s What Worked.

We researched why people were reluctant to talk about medical debt, and designed an outreach strategy based on what we learned.

A Half-Million Chicago Drivers Have Unpaid Sticker Tickets, but Only 11,400 Applied for the City’s Relief Program

Advocates for ticket reform say they’re disappointed the city didn’t do more to encourage Chicago motorists to sign up for its debt relief program. The city says more reforms are coming.

How People Are Using Our Chicago Parking Ticket Data in Their Research

Close to 1,300 people have downloaded data from our app, The Ticket Trap. We talked with some of them.

When Medical Debt Collectors Decide Who Gets Arrested

Welcome to Coffeyville, Kansas, where the judge has no law degree, debt collectors get a cut of the bail and Americans are watching their lives — and liberty — disappear in the pursuit of medical debt collection.

Have You Been Sued by a Hospital, Doctor or Other Medical Institution? Tell Us About It.

ProPublica and MLK50 have been investigating Memphis institutions that profit from the poor. Now, we want to hear from people across the country who have been sued or arrested after unpaid medical bills.

Journalists, We’re Sharing Our Tips From Patients With Medical Debt. Want Them?

Stories about aggressive debt collection are leading to real change, and we want to see more of them. Let us give you our leads from across the country.

Bailout Tracker: See Where More Than $600 Billion Went

ProPublica is still tracking where every dollar of taxpayer money from the 2008 bailout of the financial system has gone. See for yourself.

Hundreds of Thousands of Chicago Motorists Could Receive Debt Relief From Vehicle Sticker Tickets as the City Expands Reform

Attention, Chicago motorists: You have until Oct. 31 to buy a city sticker and then qualify for a new debt forgiveness program.

Here’s What to Expect From Chicago City Council’s Ticket Reform

Chicago became the largest U.S. city to enact major reforms to its system of parking fines and fees. City officials say more changes are coming.

Chicago City Council Approves Ticket and Debt Collection Reforms to Help Low-Income and Minority Motorists

The measures, which were prompted by a ProPublica Illinois and WBEZ Chicago investigation, are scheduled to take effect by mid-November.

Parents Gave Up Custody of Their Children to Help Them Get Financial Aid. Now, Some Are Abandoning That Idea.

Some families are frustrated about a public backlash, saying what they did was legal. They say the real problem is the cost of higher education.

How a Video Gambling Company Helped Bankroll Local Politicians

And updates on the creation of new casinos around the state.

Inside the Illinois House Hearing on the Financial Aid Scandal

Lawmakers described the practice as disturbing, disheartening and shocking.

At Hearing on Financial Aid Scandal, Lawmakers Grill Officials and Look to Close a Loophole

Illinois politicians considered denying admission to students whose families exploited the guardianship law to qualify for aid they wouldn’t otherwise receive, saying it was an “injustice.”

From Truck Stops to Elections, a River of Gambling Money Is Flooding Waukegan

Owners of one of Illinois’ largest video gambling companies are behind efforts to influence city politics, expand gambling and build a casino near land they control.

El Departamento de Educación Federal Quiere Frenar la “Trama Fraudulenta de Ayuda Estudiantil” en que Padres Ceden La Custodia a Través de Tutelas Dudosas

Un día después de nuestro reportaje, el inspector general del departamento dice que quiere cerrar los agujeros legales de ayuda financiera.

How We Got the Story About Parents Transferring Guardianship of Their Kids to Win Financial Aid They Wouldn’t Otherwise Qualify For

A tip, and then lots of work — including looking through nearly 2,000 files — over a very short period of time.

Illinois Lawmakers Call Hearing to “Demand Answers” and Find Ways to Close a Loophole in College Financial Aid Scandal

Legislators said parents who turn over guardianship of their children to get financial aid engaged in a “manipulative practice.” They’re exploring whether they can subpoena parents to testify.

Padres Ceden La Custodia de Sus Hijos para Conseguir Becas Universitarias Basadas en Necesidad Económica

Primero, los padres transfieren la tutela de sus hijos adolescentes a un amigo o pariente. Después, el estudiante declara independencia financiera para calificar para ayudas monetarias y becas.

U.S. Department of Education Wants to Stop “Student Aid Fraud Scheme” Where Parents Give Up Custody Through Dubious Guardianships

One day after our reporting, the department’s inspector general said it wants to close financial aid loopholes.

Illinois Parents Are Helping Their Children Get College Financial Aid They Wouldn’t Otherwise Qualify For. Help Us Figure Out How They Do It.

Are you a parent, student, school administrator or someone else who has seen this in action? We'd love to hear from you.

Parents Are Giving Up Custody of Their Kids to Get Need-Based College Financial Aid

First, parents turn over guardianship of their teenagers to a friend or relative. Then the student declares financial independence to qualify for tuition aid and scholarships.

She’s Risked Arrest by Driving With a Suspended License for Seven Years. This Week She Got Some Big News.

Some 55,000 Illinoisans could regain their driver’s licenses very soon.

Chicago Mayor Proposes Reforms That Would Make Life Easier for Thousands of Black and Low-Income Drivers

After more than a year of reporting from ProPublica Illinois and WBEZ, Mayor Lori Lightfoot announced ticketing changes and said she would support legislation to change state law — beginning to make good on a campaign promise.

Hate Getting Parking Tickets in Chicago? Here’s How You Can Start Change-Making Conversations About the City’s Ticketing System.

We’ve created an event toolkit to help communities start or continue conversations about how Chicago’s parking and vehicle ticketing system drives motorists into debt and jeopardizes livelihoods.

Nonprofit Christian Hospital Suspends Debt Collection Lawsuits Amid Furor Over Suing Its Own Employees

Methodist Le Bonheur Healthcare is reevaluating its policy after an MLK50-ProPublica investigation found that it had filed 8,300 lawsuits in the past five years, including against many of its own employees.

Chicago Can’t Hold Impounded Vehicles After Drivers File for Bankruptcy, Court Says

A federal appeals court said the city’s aggressive legal strategy, aimed at discouraging motorists with unpaid ticket debt from filing under Chapter 13, violated the basic protections of bankruptcy, and the city was doing so mostly to generate revenue.

Millionaire CEO of Nonprofit Hospital That Sues the Poor Promises Review of Policies

Methodist Le Bonheur Healthcare promised a policy review after an investigation by MLK50 and ProPublica found it had sued 8,300 patients — including its own employees — over medical debt. Its CEO has not responded to our questions.

Have You Been Sued by a Hospital, Doctor or Other Memphis Institution? Tell Us About It.

ProPublica and MLK50 are spending the year investigating the institutions that profit from people who are poor in Memphis. Share your story with us.

Low-Wage Workers Are Being Sued for Unpaid Medical Bills by a Nonprofit Christian Hospital That Employs Them

Methodist Le Bonheur Healthcare has sued many of its own employees over unpaid medical bills and garnishes their wages; its health care plan prevents them from going to competitors with better financial assistance.

The Nonprofit Hospital That Makes Millions, Owns a Collection Agency and Relentlessly Sues the Poor

Nonprofit hospitals pay virtually no local, state or federal income tax. In return, they provide community benefits, including charity care to low-income patients. In Memphis, Methodist Le Bonheur Healthcare has brought 8,300 lawsuits for unpaid medical bills in just five years.

This Memphis Hospital System Flouts IRS Rules by Not Publicly Posting Financial Assistance Policies

Nonprofit hospitals must post financial assistance policies for the public to see, including in emergency rooms. But Methodist Le Bonheur Healthcare’s five Shelby County emergency rooms had no signs or displays when a reporter checked.

How We Tallied Medical Debt Lawsuits and Wage Garnishments in Memphis

We found that Methodist Le Bonheur Healthcare filed more lawsuits and won more wage garnishment orders than any other hospital system in Shelby County. Here’s how we did it.

As Illinois Expands Gambling, It Will Also Try to Determine How Many Gambling Addicts It Has

Illinois will finally conduct a thorough study of the gambling problem in the state — the first such survey in nearly 30 years. It said it will spend more money to treat addiction, too.

Anatomy of the Gambling Bill

Illinois is going to dramatically expand gambling. Here’s the bill and what it means.

Illinois Is Poised to Become the Gambling Capital of the Midwest

And like the state’s last gambling expansion, in 2009, the massive new bill could bring trouble.

Of Course This Happened in Illinois. Why Wouldn’t It?

Lawmakers are making money from video gambling operators. A vote on gambling expansion may happen Friday.

Many People are Too Broke for Bankruptcy. A New Report Suggests Some Fixes.

For many people, filing for bankruptcy is a luxury that’s out of reach. A new report by the primary bankruptcy professional organization is full of recommendations that, if implemented, could help change that.

The Ticket Trap: Front to Back

The project gave us an opportunity to try a bunch of technical approaches that could help a small organization like ours develop sustainable news apps.

How Has the “Crack Cocaine of Gambling” Affected Illinois? The State Hasn’t Bothered to Check.

Since video gambling went live in 2012, more than 30,000 video slot and poker machines have been installed in the state and gamblers have lost more than $5 billion. Yet Illinois has failed to address the issue of gambling addiction in any meaningful way.

Everybody in Chicago’s Mayor’s Race Says They Want Ticket Reform

Proposals from the 14 candidates range from studying ticketing enforcement disparities to overhauling payment plans.

How Illinois Bet on Video Gambling and Lost

Lawmakers said legalizing video gambling would generate billions of dollars for the state. Instead, it’s proved to be little more than a money grab.

Do You Know Someone Struggling With Video Gambling? Help Us Understand Video Slot and Poker Addiction in Illinois.

More than 30,000 video gambling machines are scattered across Illinois, and gambling addiction appears to be on the rise.

How We Analyzed Video Gambling in Illinois

Here’s how we conducted an in-depth look at the rapid expansion of video gambling in the state and its financial and social costs.

Feeling Trapped by Vehicle Tickets? Let’s Talk About It — Live

We’re hosting a community forum on March 4 and would love to see you.

How to Use the Ticket Trap, Our New Database That Lets You Explore How Chicago Tickets Motorists and Collects Debt

We hope you’ll play around with it and let us know how we can make it better.

The Ticket Trap

We’ve collected data on 54 million tickets issued over the past two decades in the city. Search for your address and compare your ward with others, and see how Chicago’s reliance on ticketing affects motorists across the city.

We Want to Hear About Your Experiences With Vehicle Tickets, So We Created a Facebook Group

We’ll share our latest stories there and give you a preview of an upcoming project.

Chicago Task Force Will Take on Ticket and Debt Collection Reform

The group is part of an effort to make vehicle ticketing less unfair.

Chicago Throws Out 23,000 Duplicate Tickets Issued Since 1992 to Motorists Who Didn’t Have Vehicle Stickers

The move is the city’s latest effort to reform its troubled ticketing and debt collection practices.

Chicago City Council Approves Modest First Reforms on Ticketing and Debt

The changes signal a growing acknowledgement that the city’s reliance on fines and fees to generate revenue has come at a significant cost for some residents.

Top Chicago Alderman Adds to Growing Momentum for Ticket and Debt Reform

The proposal, the latest in a series of reforms aiming to respond to growing public pressure, would make it easier for motorists to avoid having their driver’s licenses suspended.

Chicago Considers Wiping Away Old Ticket Debt for Motorists Who File for Chapter 7 Bankruptcy

The proposal is intended to discourage drivers from filing for Chapter 13 bankruptcy, but it does nothing to change onerous payment plans for motorists who don’t file at all.

Chicago Alderman Proposes Reining in Ticket Penalties That Drove Thousands of Black Motorists Into Debt

The proposal would cap late penalties and create community service alternatives to some fines.

Chicago City Clerk Calls for Reforms of Vehicle Sticker Program

Anna Valencia proposed creating city sticker options so low-income drivers can afford to be in compliance and avoid costly tickets.

Download Chicago’s Parking Ticket Data Yourself

For the first time, the city’s database, which tracks more than 28 million parking and vehicle compliance tickets, is easily available to the public.

What’s the City of Chicago Doing About Its Problem With Duplicate Sticker Tickets?

Seven weeks after the city pledged to address the issue, drivers are still on the hook — and now Chicago’s ticketing practices are becoming an issue in the mayor’s race.

The “Terrible” Consequences of Chicago’s Ticketing Policies

The city tried to raise revenues by hiking the cost of sticker tickets, but instead hurt motorists in low-income, black neighborhoods.

Chicago Hiked the Cost of Vehicle City Sticker Violations to Boost Revenue. But It’s Driven More Low-Income, Black Motorists Into Debt.

Now, a former official regrets the move and wants the city to revisit it. Some policies, she said, are “terrible.”

How ProPublica Illinois and WBEZ Worked Together to Find Thousands of Duplicate Tickets in Chicago

We heard from you about how ticket debt, especially from $200 city sticker citations, has affected you. And we would like your help as we continue our reporting.

Chicago Begins To Rethink How Bankruptcy Lawyers Get Paid

Judges are demanding that lawyers tell their clients that their other debts might not get paid, but their lawyers will.

Some States No Longer Suspend Driver’s Licenses for Unpaid Fines. Will Illinois Join Them?

Our analysis shows suspensions tied to ticket debt disproportionately affect motorists in largely black sections of Chicago and its suburbs.

She Owed $102,158.40 in Unpaid Tickets, but She’s Not in the Story

Still, we want to tell you a little bit about her, and about some of the other people we interviewed, because they helped inform our ticket debt investigation.

How Chicago Ticket Debt Sends Black Motorists Into Bankruptcy

A cash-strapped city employs punitive measures to collect from cash-strapped black residents — and lawyers benefit.

The Many Roads to Bankruptcy

Here are some stories of Chicagoans driven into ticket debt.

Without Fanfare, Equifax Makes Bankruptcy Change That Affects Hundreds of Thousands

For years, an Equifax policy has treated some Chapter 13 filers differently than the other two major credit rating agencies. After ProPublica asked about it, the company said it would change the policy.

Chicago’s Bankruptcy Boom

ProPublica’s analysis of racial disparities in bankruptcy revealed a skyrocketing number of filings in Chicago’s black neighborhoods. But most of the cases will fall apart before the debts are wiped away.

Have You Seriously Considered Filing for Bankruptcy?

If you’ve really thought about filing for bankruptcy, ProPublica wants to hear from you — even if you ultimately decided against it.

In the South, Bankruptcy Is Different, Especially for Black Debtors

Only in the South is Chapter 13 the predominant form of bankruptcy. We mapped Chapter 13’s usage to show that it breaks not only along regional, but also racial lines.

Data Analysis: Bankruptcy and Race in America

An in-depth discussion of racial patterns in bankruptcy filings and outcomes

Bankruptcy: What’s the Difference Between Chapter 7 and Chapter 13?

Key differences between the chapters make choosing the right one critical for success. Using our analysis, we explain how they work and how people fare under each.

How the Bankruptcy System Is Failing Black Americans

Black people struggling with debts are far less likely than their white peers to gain lasting relief from bankruptcy, according to a ProPublica analysis. Primarily to blame is a style of bankruptcy practiced by lawyers in the South.

What Can Be Done Right Now to Fix the Legal System for Debt Collection

America’s out-of-date, unfair laws for collecting debts could be dramatically improved by these simple steps.

The Color of Debt: How Collection Suits Squeeze Black Neighborhoods

In a first-of-its-kind analysis, ProPublica reveals that the suits are far more common in black communities than white ones.

How We Analyzed Racial Disparity in Debt Collection Lawsuits

An explanation of how we analyzed whether debt collection lawsuits disproportionately impact black communities.